悉尼大学,投资和投资组合管理-FINC3017课程的学习练习题复习要点

Hello~大家好,今天学姐为留学生分享投资和投资组合管理-FINC3017课程的学习技巧,这期的内容主要是给各位同学分享一些非常不错的练习题,学姐整理了非常详细的流程细节可以参考。

BHB Q7.4 What are the key assumptions underlying expected utility and how realistic are these assumptions?

2. BHB Q7.5 Is expected utility a useful criterion for investment choice when investment pay-offs are certain?

3. BHB Q7.6 How are different combinations of assets compared when using the concept of utility?

4. BHB Q7.7 How does the level of risk affect the curvature of indifference curves?

5. BHB Q7.9 List two situations where expected return and standard deviation are sufficient to describe the choice between risky portfolios?

6. BHB Q7.22 Investment A provides a 40% chance of paying $1000 (good year) and a 60% chance of paying $200 (bad year). Alternatively, investment B has a 50% chance of paying $800 (good year) and a 50% chance of paying $500 (bad year). The pay-off varies across investments and according to the state of the world. Which investment will be preferred if the investor has logarithmic preference functions?

7. BHB Q7.18 In estimating the opportunity set, does the assumption that the expected returns, variances and covariances are known with certainty matter?

8. Define the efficient frontier. How does it differ from the minimum variance frontier?

9. How is the correlation statistic related to diversification? Can a diversified portfolio be created with two assets with a correlation coefficient of +1?

10. A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields at a rate of 8%. The probability distribution of the risky funds is as

11. In estimating the opportunity set, does the assumption that the expected returns, variances and covariances are known with certainty matter? The expected returns may be estimated with error and the error may not be consistent across securities. For example the level of information varies across securities and so the precision of the estimates will also vary across securities. If estimates are prone to error the opportunity set may concentrate on those securities with greatest error rather than those companies which best meet the needs of the investor. This result is often termed error maximisation and can result in a portfolio that concentrates on a fairly small subset of the available securities. These are the securities with greatest expected returns and/or least variance and covariance effect, often the most likely to suffer from data entry errors and errors in analysis. The key point to note is the importance of accurate measures of expected return, variance and covariance and the possibility that a number of ‘approximately optimal’ portfolios may exist in practice.

12. The ABC company wants to invest in two risky assets over the next 12 months. Analysts predict that the expected return on asset A is 5% per annum and on asset B it is 7% per annum. The standard deviation of the returns for asset A is 8% and for asset B it is 9%. The correlation between the two assets in 0.4 and the risk-free rate is 5.5% per annum. What combination of the two assets will give returns that exceed the risk-free rate? The question requires an estimate of the weights in the risky assets that produces a portfolio return that exceeds the return on the risk-free asset. By altering the weights in each asset, the portfolio return changes as follows: E(Ra) E(Rb) wa wb E(Rp) 5% 7% 100% 0% 1.00x5% + 0.00x7% = 5% 5% 7% 75% 25% 0.75x5% + 0.25x7% = 5.5% 5% 7% 50% 50% 0.50x5% + 0.50x7% = 6% 5% 7% 25% 75% 0.25x5% + 0.75x7% = 6.5% 5% 7% 0% 100% 0.00x5% + 1.00x7% = 7% Clearly, as the weight in asset A decreases (weight in asset B increases), the return on the portfolio increases. As can be seen, when the weight in Asset A is less than 75%, the return on the portfolio exceeds the risk-free return of 5.5%. Alternatively, we can solve: wa E(Ra) + (1–wa) E(Rb) > 5.5% wa 5 + (1–wa)7 > 5.5% 5 wa + 7 – 7 wa > 5.5% –2 wa > –1.5 wa

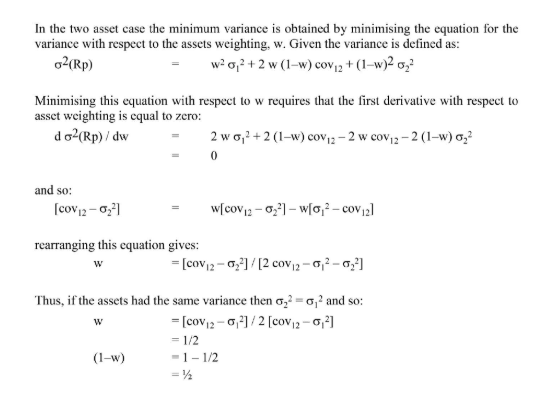

13. What are the minimum variance weightings for a two-asset portfolio where both assets have the same variance?

考而思悉尼大学,投资和投资组合管理相关的在线辅导可以加考而思老师微信进行一对一咨询。

凡来源标注“考而思”均为考而思原创文章,版权均属考而思教育所以,任何媒体、网站或个人不得转载,否则追究法律责任。

kaoersi03